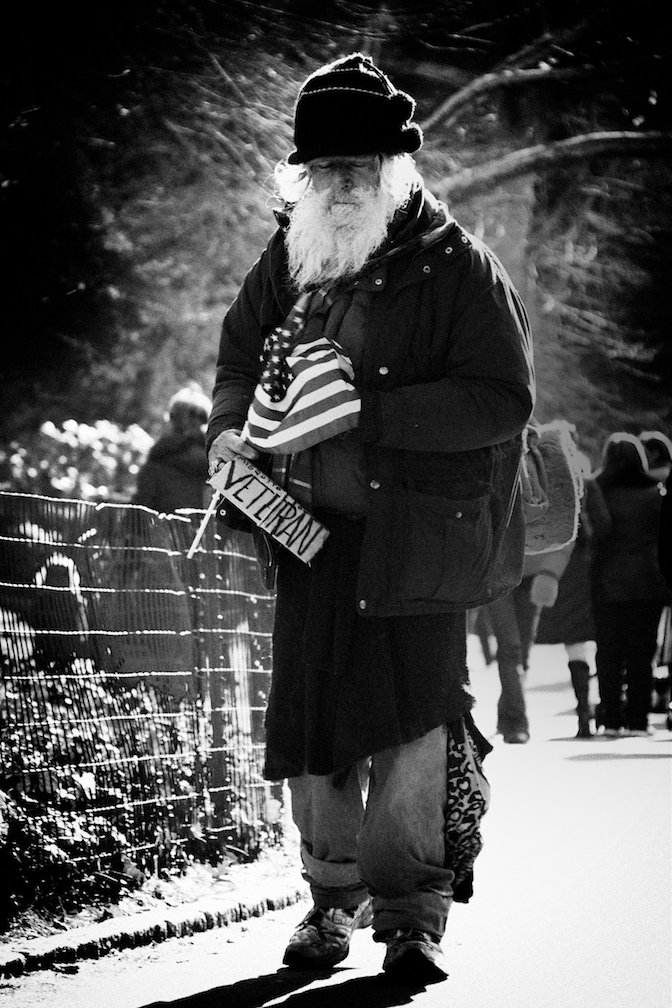

With the extremely long delay in obtaining benefits from the Department of Veterans Affairs (VA), many Veterans face tremendous and crippling medical bills. These bills impact ability to pay for necessities, including rent, utilities, transportation, and even food.

With the extremely long delay in obtaining benefits from the Department of Veterans Affairs (VA), many Veterans face tremendous and crippling medical bills. These bills impact ability to pay for necessities, including rent, utilities, transportation, and even food.

KNOW YOUR RIGHTS: VA BENEFITS ARE PROTECTED!

Threats and constant calls from creditors and even advice from attorneys not familiar with Veterans benefits matters may push Veterans to make unwise decisions regarding their VA benefits. It’s very simple: VA benefits are protected from creditors, taxation, and other legal processes. No one is entitled to just take your benefits away to pay off debts.

We Can Help You Because We Know

The Law Office of Robert B. Goss, P.C. is accredited by VA. We understand the rules surrounding VA benefits. Not all attorneys are familiar with the special rules regarding Veterans’ benefits. For example, one Veteran desperately e-mailed our Managing Attorney, Bob Goss, because the Veteran was going through bankruptcy. The Veteran’s bankruptcy attorney wanted to include the Veteran’s VA disability payments as an asset so a hospital could collect and garnish additional money. Fortunately, the Veteran contacted Bob first. As it turned out, the bankruptcy advice was incorrect. For Veterans, the general rule is this: Veterans’ benefits are exempt from attachment or garnishment by creditors.

Many legal rules that apply to other income sources don’t apply to Veterans benefits. Unless a person is familiar with laws, regulations, and VA policies on Veterans benefits, the person would not know that VA benefits (including disability payments) are generally protected from creditors. Here at the Law Office of Robert B. Goss, P.C., we do understand how your VA benefits are protected.

WHICH BENEFITS ARE PROTECTED?

Congress protects VA benefits to ensure disabled Veterans and their families are cared for. Congressional protection for Veterans includes shielding of Veteran’s VA benefits as well as proceeds received from Service Members Group Life Insurance, or from Veterans Group Life Insurance policies payments. Congressional protection for Veterans’ benefits can be found at:

- 38 U.S.C. § 5301(a) – VA benefits are generally exempt from taxation, creditors, or other legal seizure. This protection of VA benefits includes protection once the monies are deposited into a bank “either before or after receipt by the beneficiary”;

- 42 U.S.C. § 659(h)(1)(B)(iii) – VA benefits are generally exempt from income withholding, garnishment, and similar proceedings for enforcement of child support and alimony obligations; and

- 38 U.S.C. §1970(g) – Certain insurance payouts to Veterans are exempt from taxation, creditors, or other legal seizure.

OTHER SPECIFIC PROTECTIONS

VA benefits deposited in banks

As noted above, protection of your VA benefits includes protection once the monies are deposited into a bank “either before or after receipt by the beneficiary.” Social Security benefits and other federal-benefit payments deposited in banks are also protected.

To prevent creditors from garnishing bank accounts, Congress requires any credit agency trying to freeze a Veteran’s VA disability benefits to follow certain legal procedures. Essentially, a debt collector must verify that no VA benefits have been deposited in the bank in the last two months. Thus, the Veteran has protection for at least two months’ worth of VA disability payments.

Texas-specific protections

For Texas residents, the Texas Constitution makes it illegal for a creditor to garnish your wages except for court-ordered enforcement of child-support payments or spousal maintenance. See Article 16, Section 28 of the Texas Constitution.

- The Law Office of Robert B. Goss has successfully fought and reversed an out-of-state (Ohio) wage-garnishment order.

Texas also provides homestead protection for Veterans and shields many other Veteran assets.

Property Tax exemptions are available for 100% disabled Veterans living in Texas, including Total Disability/Individual Unemployability (TDIU) Veterans. Although 100% disabled Veterans (including TDIU Veterans) must apply to receive property tax exemptions, the application process is not generally difficult. Contact us if you would like assistance with your exemption request.

EXCEPTIONS

There are a few exceptions to the general rule that Veterans’ benefits are completely protected. You will immediately notice that this is the opposite of the general rule which makes assets available for creditors, taxation, and legal seizure – unless there’s a specific law protecting those assets. Now you know why many people can be confused and think Veterans’ benefits are always available to creditors. This is why you need someone who is familiar with and understands Veterans’ benefits law.

Exception #1: VA Overpayments

In the case of an overpayment, VA is allowed to recoup this money. However, VA often miscalculates, so merely because they claim they’ve overpaid you doesn’t mean they have. And – if they did make a mistake, or even if you made a mistake – you are entitled to negotiate a repayment plan that works with your budget.

If you have been notified by VA that they have overpaid you…DO NOT WAIT to contact us. Unless you respond to VA within 60 days of their notice, they can start lowering your payments. See our explanation of this process, and contact us today!

Exception #2: Child Support

Child support is another area allowing garnishment. In the case of Rose v. Rose, 481 U.S. 619 (1987), the Supreme Court of the United States ruled that states have a right to collect child support through court orders. Specifically, in Rose v. Rose, the Supreme Court held that a state court can hold a disabled Veteran in contempt for failing to pay child support, even if the Veteran’s only means of satisfying this obligation is using Veterans’ benefits received as compensation for a service-connected disability.

Exception #3: Taxation

Any property purchased with VA disability payments may lose its tax-exempt protection.

BOTTOM LINE

Our goal is to assist Veterans and their families. This article is intended to help you know your rights and prevail when confronted by unscrupulous debt collectors. It is also intended to alert you to common misinformation about Veterans’ Benefits and bankruptcy proceedings.

Remember: any notice from VA or creditors should not be ignored. They won’t improve with time. The good news is, by taking prompt, early action, you are in the best position to maintain or improve your situation. DON’T WAIT. Contact the Law Office of Robert B. Goss, P.C. today for your FREE consultation.

Military Veterans' Lawyer Blog

Military Veterans' Lawyer Blog